It would be an understatement to say techpreneur and founder of stokvel app Tshepo Moloi and his team have had an interesting year.

It would be an understatement to say techpreneur and founder of stokvel app Tshepo Moloi and his team have had an interesting year.

StokFella launched last year with the goal of revolutionising the stokvel economy which is estimated to be around R49 billion in South Africa alone, according to the National Stokvel Association of South Africa.

Within a year the app has managed to get close to 5 000 app downloads with over 500 stokvel groups signing on to use the app, and the startup successfully secured a million rands in funding from Merrill Lynch South Africa and Rand Merchant Bank‘s AlphaCode.

They are also taking advantage of the wealth of opportunities in Africa’s tech sector, says Moloi. Just earlier this year the startup expanded their offering to include transactional banking services.

The app now not only allows stokvel groups and their members to manage all the stokvel’s payments, claims and admin from mobile phones, with their new capabilities, stokvel members can now use the app to monitor payments, manage their savings and also access those savings whenever they need to, Moloi says.

There have also been challenges, like having to navigate the laws that regulate the financial sector and that their app has to comply with and having to conduct extensive education of their market. These meant their growth has not been as rapid as they would have liked, says Moloi.

“We’re happy that the industry is now growing and we’re happy that the StokFella app has led that conversation and we continue to be a part of it”

To find out what the opportunities and challenges rookie founders in the fintech space may need to navigate, SME South Africa speaks to Moloi.

Tech Is Still A Worthwhile Sector To Get Into

If you are going to be coming into the industry, one of the challenges you’ll be facing [is access to market]. South Africa has great legislation but it also hinders your ability to move quickly. Whatever you do, from a fintech perspective, make sure you understand regulation. If you don’t you will probably find it very challenging at the same time.

There Is More To Tech Than Fintech

And the truth is that I think everyone wants to go in the fintech [because they get a lot of support from] venture capitalists, but there are other industries out there that need disruption. The legal industry, when I read, is the next to get disrupted. I think people need to look beyond finance and see how they can disrupt those industries that have been stagnant.

We Found That Our Early Adopters Were Quite Tech-Savvy

Our users actually are roughly between 27 and 39 years old. They have been our early adopters, what we call the first wave. The first wave is usually the guys who are tech-savvy – the young up-and-coming junior manager or corporate guy who wants to get more out of their money. Those are the kinds of people we see that are coming through quicker than the others.

But something that we also see is that tech usually comes in a couple of waves for that adoption, we’ve seen the first adoption and we’re now on the second wave of adoption which includes the older generation of stokvel patrons.

More Needs To Be Done To Drive Financial Literacy

Educating the market has been a bit of a challenge. We haven’t been moving as quickly as we would have liked. With the launch of version 2.0 of StokFella we wanted to integrate unit trust capability to take advantage of the value of better interest rates offered by unit trusts. But that comes with the question of ‘are you risk profiling adequately, do the users understand what unit trusts are, and if they understand, then they would also want to understand the fee structures and so on.

Technology needs to be simple, quick, fast. But because of that element [of educating the market] we actually needed to sit back and ask ourselves ‘what can we do?’

So those are the questions that perhaps impeded our growth. But in spite of that, we’ve grown quicker than anyone would have expected us to grow.

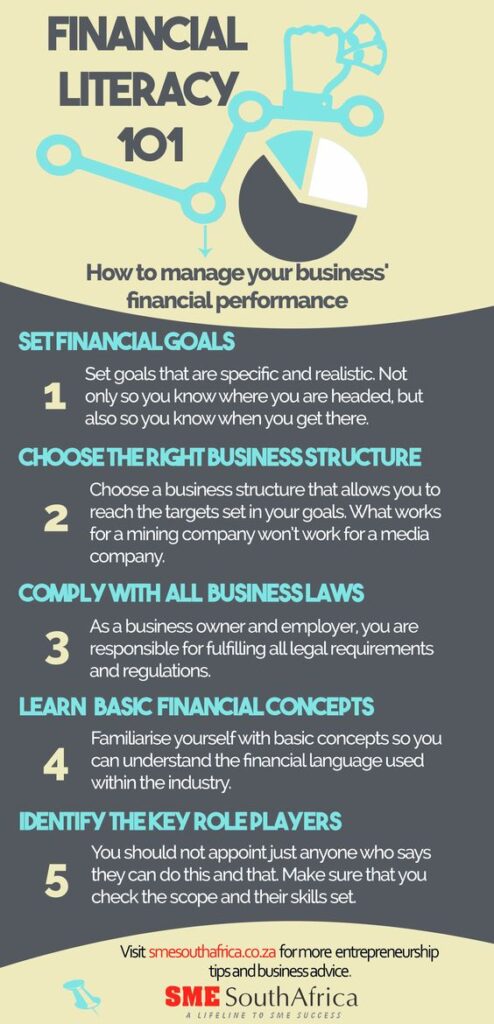

What we’ve also learnt is that there’s more that needs to be done in terms of financial literacy in the country. Because even with the guys who’ve downloaded and understand the app, they would still ask financial literacy questions and tend to want financial advice.

See also: 2 Young Entrepreneurs On How They Are Using Tech To Take Advantage Of Opportunities In The Township Market

#DataMustFall – We Found A Way Around High Data Costs

[The high data costs in the country] is somewhat of a factor, but what we’ve done as StokFella is that as part of version 2.0, we’ve enabled users to connect as mobi, meaning that you actually don’t need to download the app. You can actually access StokFella by normal web-enabled phone, or on your laptop or desktop. We’ve done that to eliminate the concept of downloading which uses up a lot of your data.

This also means that we are able to upgrade with fewer downloads. If I tell you that ever since we’ve launched version 2.0 of StokFella we’ve actually done almost 15 updates but [the user only needed to download once]. That tells you that as a person you don’t actually spend your data to actually get an update of StokFella.

We’re Creating The Ultimate Stokvel Solution

The next phase of StokFella is that the app is to become more of financial transaction solution where we have the ability to manage your money, where you can actually put your money in and it’s fully automated, it’s safe and secure, and whenever there’s a claim, you can get [money] whenever you want. So that’s what we launched in February at the Hook-up Dinner, but we launched it as a pilot.

On the back of that, some of our users have been saying that they want to gain interest, so that’s the next step that we are trying to put together. A solution that not only allows you to put your money through the platform like a normal StokFella account, but can also give you that interest. Ideally, that’s better than any stokvel account around.

Competition Keeps Us On Our A-Game

I think what we did last year was shine a light on the industry that everyone wanted to get into, but did not know how to go about it. We found corporates trying to interview us because they were trying to understand where StokFella is going to next.

We know the competition is really out there, we know a couple of businesses have come out and we’re seeing similar solutions.

But we can only say that competition is good, because it means that it brings our game up, it means that the value that we need to offer should be clearer than any other solutions. It means that ultimately the end user will be getting more value.

So for us we’re happy that the industry is now growing and we’re happy that the StokFella app has led that conversation and we continue to be a part of it.

We Aren’t The Only Success Story

The past three years have seen South African tech, particularly your black-owned startups, gain momentum. SweepSouth and Tuta-Me are great examples. So in the past three years or so, we have seen a great wave of young black entrepreneurs coming up with great solutions. I think [the success we have experienced] is industry wide.