We are able to compare insurance quotes, grocery prices and even business funding options; now there is a startup that wants to help ordinary individuals compare saving options.

We are able to compare insurance quotes, grocery prices and even business funding options; now there is a startup that wants to help ordinary individuals compare saving options.

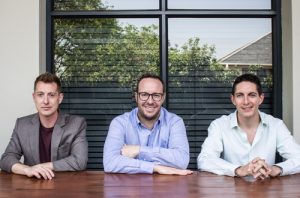

MyTreasury was founded by Michael Kransdorff, Daniel Rubenstein and Simon Shear – all in their mid 30s – in 2016. The Johannesburg-based startup wants to help South Africans maximise their wealth by helping them find the savings accounts with the highest interest rates for their savings preferences.

The savings market continues to be extremely complex and opaque, says Rubenstein,”it has been virtually impossible until now to find the optimum place to invest your savings. MyTreasury’s Savings Optimiser makes it easy for anyone to instantly find the right bank account.”

Rubenstein experienced the hassles of securing the right saving and investment options first-hand. After selling his stake in a listed property company he struggled with the decision of where to invest the money. What he thought would be a relatively straightforward process was anything but. “There was no efficient way to compare the hundreds of rates on the market and to know which account would both meet my savings requirements and offer the best returns.”

He finally made, what he says, was a more or less arbitrary decision. A week later, his private banker at a rival bank informed him he could have gotten a better rate and better liquidity with one of their products.

“So the idea for the MyTreasury Savings Optimiser was born from a personal need to find a more effective way to find the best savings account, and from a realisation that all South Africans would benefit from the savings space becoming more transparent and competitive.”

Making this possible has not been without its challenges. SME South Africa speaks to the MyTreasury founders about not giving away equity too cheaply too soon and having to juggle tech, user experience and regulatory considerations.

On Funding

There was a lot of buzz about the ‘lean startup’ concept at Harvard Business School when co-founder Michael Kransdorff was doing his graduate studies. It must have rubbed off, because lean startup principles inform our entrepreneurial approach.

We’re data-driven, and we rigorously test user response and adjust our platform accordingly. But we also believe in being flexible in implementing features because we’ve identified a consumer need and an area where we think the public would be better served by transparent, efficient access to information.

The MyTreasury interface.

We’re fortunate to be able to self-finance the current phase of our business. We’ve seen too many instances of entrepreneurs giving away equity too cheaply too soon. We believe in our business and we don’t want to dilute it without adding real value.

On Gaining Traction

We’ve been overwhelmed by the response from users. We knew the service would be helpful, but we weren’t expecting so many people to reach out to us to express their appreciation for the service. The lesson seems to be that South Africans want independent, transparent sources of information to help them make better consumer decisions.

On Marketing

As an online service, we’re naturally focusing on data-driven digital advertising. We’ve also had a positive response from radio and print features about MyTreasury.

Launching a Fintech startup In SA

Starting a fintech business in South Africa can be challenging. Financial institutions are relatively conservative and consumers are wary of new technologies, especially when it comes to their money. We have been fortunate to receive support from fellow entrepreneurs and more forward thinking financial institutions. Being members of AlphaCode’s fintech hub, we have been able to connect with experts in various business fields, who have provided us with invaluable advice.

Standing out from Competitors

MyTreasury isn’t just another comparison site. You don’t need any special expertise to use MyTreasury Optimiser, and you don’t have to know what you’re looking for before you find it. Users simply enter their savings preferences (such as how much they have to invest and how quickly they want to access their cash) and the Optimiser matches them to the relevant savings account that offers the best rate. Using MyTreasury Savings Optimiser, anyone can instantly find the best returns on their cash savings.

MyTreasury’s Money Matters magazine is another unique offering. We aspire to provide informed analysis of economic trends and help to explain often complex financial products in an easily accessible way.

The Biggest Challenges we have had to overcome

There are so many moving parts to coordinate. We need to constantly work to coordinate tech, user experience, regulatory considerations and business decisions.

“If others can’t yet appreciate your vision, convince them by making it a reality”

Biggest surprise about being a Startup Founder

As a digital platform, we’ve been surprised by the strong uptake from offline sources. People will hear about us on the radio or read about us in newspapers or magazines, and go online and use MyTreasury Optimiser. Clearly people are motivated to find the best rate.

When we knew we could succeed

We were always confident about the product. We know it’s a useful service that can help anyone with cash on hand to maximise their wealth. But there’s always uncertainty, especially given people’s resistance to using new online tools. It wasn’t until we saw the rate of uptake, as well as the really positive user feedback, that we realised the potential of this business.

On Success Factors

Our commitment to helping South Africans find a wiser way to save. We have a great team, with diverse skills that complement each other.

On South African Entrepreneurship

South Africa is at heart an entrepreneurial nation. Problem solving is in our DNA. However it’s in the practical aspects of starting and running businesses where we fall short. There are many young people with great vision and entrepreneurial spirit, but it’s hard for them to speak to the right people, get access to capital and find mentoring.

Our Vision for MyTreasury

The sky’s the limit. 16 million South Africans have cash in savings accounts, and we want to help them all secure the best returns. Our goal is to be thought leaders in savings and to continue to be an independent source of financial information so that South Africans can make more informed choices about investing their money.

Advice for other entrepreneurs

Never take no for an answer. If others can’t yet appreciate your vision, convince them by making it a reality.

What we wish we had known starting out

We’re still learning every day. You need to be adaptable. Nobody has all the answers; everyone is working it out as they go along.