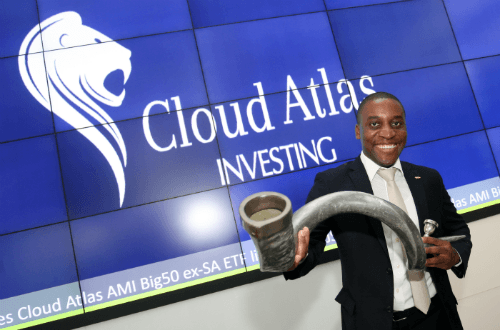

In April this year Cloud Atlas Investing, a Johannesburg-based investment firm made its debut on the Johannesburg Stock Exchange (JSE).

This is a big moment, says Maurice Madiba, Cloud Atlas CEO and founding director about the listing. “Now, for the first time ever, investors can get a cheap way to invest in African markets.”

“This on its own is the beginning of a new chapter in the story of Africa and also a monumental milestone for Cloud Atlas, a black youth-founded business in Johannesburg,” Madiba says.

Cloud Atlas is an exchange-traded fund (ETF). EFTs are investments that track the performance of a group or ‘basket’ of shares, bonds or commodities.

Their Big50 Ex-SA ETF is the JSE’s first Africa-focused ETF. It gives investors access to 50 African blue-chip companies outside South Africa through 15 African stock exchanges in countries such as Egypt, Mauritius, Kenya, Morocco, Tanzania, Nigeria, Tunisia, Botswana, Namibia, Uganda, Ghana and Zimbabwe, as well as the BRVM Exchange in West Africa.

Both individual investors and institutional investors have the opportunity to invest, with institutional investors being able to invest up to five per cent of a fund’s capital in African investments.

Increasing Access

At the announcement of the JSE listing, Madiba said they hope to increase access to African markets with the listing.

“We want to improve liquidity and [to] help to develop African markets for investors to feel the full robustness of these markets, and as such, have chosen to invest in stocks that are listed on African exchanges. These could include stocks in multinationals that are listed on African exchanges, as well as local African companies.”

A big part of what Cloud Atlas is also trying to achieve is to increase financial knowledge and inclusion of the stock market, says Madiba, as well as help to keep investment costs low.

“I was exposed to hedge funds by my previous employer and this allowed me to see how the majority of people are excluded from the returns of the stock market. It was also in thinking of the investor and their needs that setting up a legitimate investment company came about.

“Many people were excluded from being able to efficiently direct their investments. There is a lot of trust placed in people who manage other people’s money and at times it would pain me to hear that people weren’t achieving returns in their investment portfolio when the stock market ran [between] 12% and 14%,” he says.

Early Opportunities

Madiba grew up in the small suburb of Malanshof in Johannesburg. While completing his high school, Madiba was chosen for the Student Sponsorship Programme, which provides educational opportunities to high-potential scholars from low-income families to enable them to attend the best secondary schools in South Africa.

This early opportunity laid the groundwork for everything that followed, says Madiba.

“It was massive. My mentor on the SSP programme started his own business when I started [my] first year and after graduating [from the University of the Witwatersrand], he let me work with him for a few months.

“It was also through SSP [that] I got the chance to apply for the Allan Gray Orbis Foundation scholarship which runs an entrepreneurial programme designed to create high impact businesses. Through the scholarship I was eligible to apply for funding from E Squared Investment, so everything had a ripple effect.”

Before Cloud Atlas Madiba worked as a finance intern at Nedbank and Absa before joining the National Empowerment Fund. He also worked as a junior analyst at Convergence Partners, a private equity firm, and later joined Deutsche Bank where he was the client representative for pension funds, LISPs (linked investments service providers) and hedge funds that traded both domestic and foreign asset classes.

See Also: A Guide to Listing on the JSE

Obstacles We Conquered

One of the earlier challenges they faced, like many other entrepreneurs, was securing funding. Madiba says they were essentially asking investors to fund a business that had not yet generated any revenue, unlike a typical business where investors fund a business with a proven proof of concept and that may also already be making sales.

“We were fortunate to find investors who were willing to go with the vision of the type of company we wanted to create and they stuck with us through this. We had Angel investors called Mtizamo Africa. Our second round of capital was also difficult to onboard, but they had spent months getting to know our offering, then E Squared Investment came on board exactly one year before our listing.

Like other South African investment companies, Cloud Atlas also had to navigate the regulations that govern the stock market.

“Our regulators are probably among the best in the world, but at times the policies they regulate us on are designed for a monopolistic capital system. I can commend our regulators for giving us an ear when we bought this to their attention and making policy adjustments where needed. It was a critical point for the business and I’m very happy they made it possible to be listed today,” says Madiba.

See also: Listing On The JSE As An Expansion Strategy For Your Business – Everything You Need To Know

The challenge they didn’t anticipate Madiba says, is how much work would have to go into educating people about the stock market, how to invest, as well as explaining why Africa presented a good investment opportunity.

“These [African] markets have been through the worst and learnt a lot of lessons for their mistakes and misfortunes. This means an investor buying now is buying at the bottom,” says Madiba.

Each One Teach One

For beginner investors, Madiba’s recommendation is EFTs because the shares are bundled which means an investor does not have to track each share and they get to cushion potential loses.

“To learn how to buy a stock is hard enough. Now imagine trying to pick the right stock to invest in,” he says.

“An ETF allows an investor to get exposure to the performance of the market, without being exposed to one company or sector in particular. ETFs are also cheap, so once you buy your first one, buying other ETFs and even stocks is a lot easier.”