How to build a good credit profile for your business

Many entrepreneurs will be familiar with the sometimes complex processes and procedures of getting credit from a bank.

These can include a complete assessment of the credit readiness of your business, and also an examination of the likelihood of you being able to pay back what you borrowed.

Ethel Nyembe, head of small enterprise at Standard Bank says there are steps that SMEs can take to make this process easier – what she calls the five “C’s”.

How to increase your chances

According to Nyembe any business owner who follows the five “C’s” demonstrates that they are serious about their business and are looking to interact with the bank responsibly.

“The owner needs to show a good record of repaying debt, and a good record in the industry in which they operate”

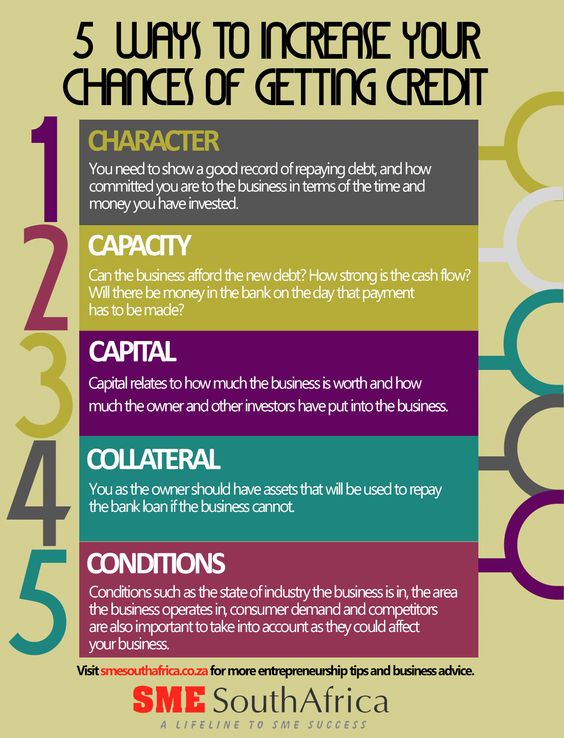

Here are her five ways to increase your chances of getting credit:

1. Character

This relates to the business owner’s personal records, behaviours and attitudes, says Nyembe.

“The owner needs to show a good record of repaying debt, a good record in the industry in which they operate (including qualifications, certification, industry networks, and customer base), how committed they are to their business in terms of the time and money they have invested, and how much business management capability they have,” she says.

2. Capacity

This, according to Nyembe, relates to the business’ ability to repay specific amounts at specific times. Nyembe says entrepreneurs should ask themselves the following questions: can their business afford the new debt? How strong is the busineses’s cash flow? How reliable is the owner’s income? And will there be money in the bank on the day that payment has to be made?

3. Capital

Capital refers to how much the business is worth in Rand terms, how much the owner and other investors have put into the business, and whether the owner has other means of settling the debt if the business cannot. This, Nyembe says, does play a crucial role in whether you get credit.

4. Collateral

This is about the assets the owner agrees to use to repay the bank if your business cannot.

5. Conditions

The bank, Nyembe explains, does take into account external factors that could affect your business.

“Environmental conditions refers to the general state of industry the business is in and the area where the business operates, consumer demand, the state of the national economy, competitors, and the banks’ risk appetite as a result of all these factors.

“Conditions also includes the purpose for which finance is needed. The owner needs to show that the loan will be used to develop the business instead of getting it out of trouble,” she adds.