Some of the reasons why millennials aren’t saving effectively include fragmented financial literacy, inconvenient channels to access financial products, complex financial product language, low affordability and accessibility to financial advisors and planners. Enter Akiba.

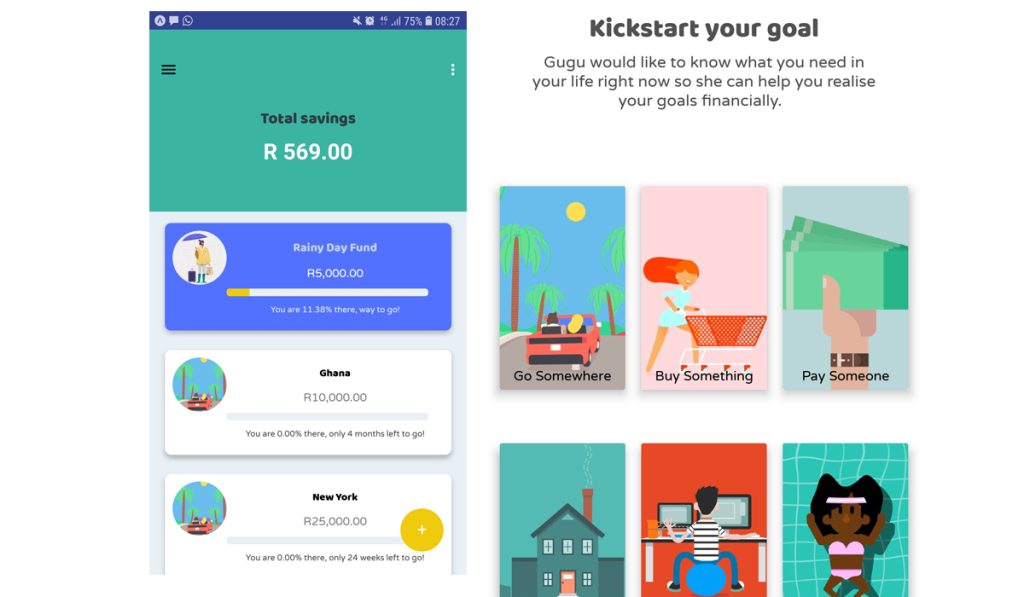

Akiba is working towards becoming a data-driven personalised financial marketplace that will initially offer two digital solutions. Their first solution, available for download, is a gamified savings tool (mobile app) that allows users to save towards their lifestyle goals and get rewarded for it. This is coupled with a rainy-day-fund pre-configured for users where a portion of their contributions to their active goals is passively saved to serve as a cushion for their future.

The second solution launching soon, will be a web-based financial literacy platform that repurposes existing content created by financial service providers. For corporate clients, this will act as a financial habits research tool and for millennials, a financial education distribution platform.

As sexy as selfies

“We want to be the movers and shakers in making financial wellbeing as sexy as selfies for our generation. For that, we’ve taken the mission to empower millennials through interactive access to financial literacy with the right personalised financial tools. We believe that once people have a better understanding of their finances, they will be better equipped to make informed and effective decisions,” states Tebogo Mokwena, Co-founder and CTO of Akiba.

The literacy platform will offer fun-financial curated content that is personalised to each user’s particular money personality, coupled with a rewards programme as part of the engagement incentive for users.

Gugu, fondly nicknamed Gugu the Shepherd, is a built-in AI-powered bot, who helps shepherd your money on the app. In addition, she will be the financial coach on the literacy platform to make sure that everything you learn is relevant. Akiba’s aim is for Gugu to own savings in South Africa for millennials, and to get South Africans familiar and confident with their personal finances.

Akiba has already seen tremendous success to date. This year they were selected in the Top 10 from a pool of 1004 applicants, to participate in the Startupbootcamp AfriTech 2018 Accelerator Programme. Other achievements for the team in 2018 include being chosen in the Top 10 for MTN Solution Space, being selected for the Top 12 of the Luxembourg House of Financial Technology and recently selected as one of eight fintech startups awarded a R2 million funding package from AlphaCode Incubate, an RMI sponsored programme.

Head of AlphaCode and RMI Senior Investment Executive, Dominique Collett, states: “We are excited by Akiba’s focus on user experience and using elements of gamification to drive financial wellness amongst millennials. The team impressed us with their energy and insight into the financial behaviours of SA’s youth.”