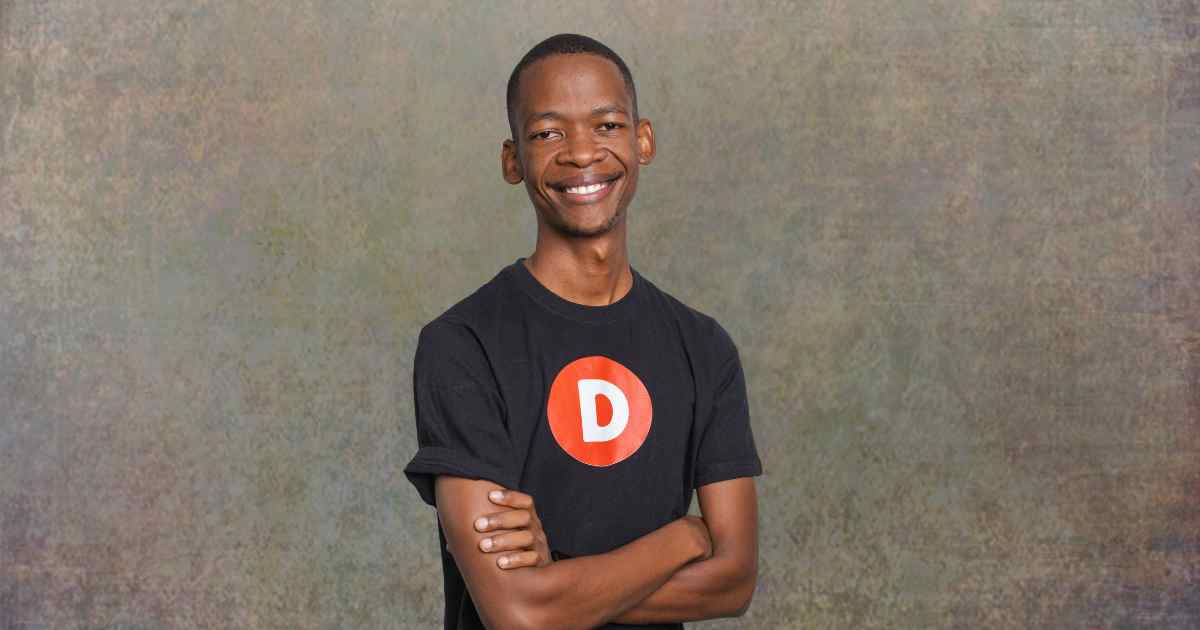

Darlene Menzies is the CEO of Finfind, an innovative online platform linking finance seekers with matching SA funders, providing access to more than 270 lenders and 500 funding options.

Menzies breaks down everything you have ever wanted to know about the seemingly widening gap between SMEs and funders, including:

– What it will take to bridge the gap between South African entrepreneurs and funders

– A funder’s perspective on entrepreneurs

– What funders are looking for

– What you need to successfully apply for funding

I have met hundreds of entrepreneurs who are looking for funding – from those who have an idea and are trying to raise seed capital to start their business, to owners of high-growth businesses who need expansion finance, and everyone in between.

Whether they are looking for a loan or for someone to invest in their business, they generally have the same thing in common – they don’t know how to go about securing the funding they need.

What entrepreneurs say about accessing finance

Most entrepreneurs don’t know where to start when it comes to applying for finance. The world of funding is largely foreign territory to them, and learning to navigate it can be a challenge. Applying for finance is a daunting task. Entrepreneurs often tell me that they feel like the odds are stacked against them before they even start, and those who have tried say that it seems almost impossible to get funding unless you’re a big, or well-established business.

One of the main challenges is knowing who the right funders are to approach, or even just knowing who all the funders are (besides the banks of course). Most startups and small businesses have tried to get funding from a bank, usually without much success. Banks view small business lending as high risk.

When you ask about Government funding, the common response is that they know there is funding available, but that it is very difficult to secure. If you are successful, it takes forever for the funds to be paid to you, which often occurs after the opportunity which required funding has been lost.

Understanding what type of funding to apply for is another obstacle. While most people are aware there are options available, they don’t know which ones match their particular business and their funding need, or what the best terms and rates are. Most are happy to go with whatever finance they can secure, with the cost and terms of the funding being a secondary concern. When it comes to funding, the majority of entrepreneurs are in the dark.

Where do most startups get money from?

Lenders don’t usually loan money to brand-new businesses or very early stage businesses as these can’t show proof of their ability to generate income and pay expenses.

It is important to understand that the higher the risk the lender will need to take, the more expensive the funding will be, and the funding terms will be more onerous. That’s why loan sharks charge such punitive interest rates, because they do minimal risk assessing and take very high risks.

In my experience the best place for an entrepreneur to go to borrow money in the startup and early stage of their business, when there isn’t much to assess, is from their existing network of friends and family.

While it may feel very uncomfortable or be difficult to approach people they know for money, they are far more likely to secure loans or seed donations from people who know them well, especially as far as their integrity and dedication to hard work is concerned. They need to approach people who already believe in their ability to deliver on their business goals and are willing to back them before the hard evidence exists that lenders require to assess it.

Why do SA funders make it so difficult to get finance?

Finance seekers may feel that funders are doing their best to make it as difficult for them to access the finance they are supposed to be providing, but the reality is that funders view funding through the lens of risk.

Whether they are investing or loaning the money, they are measured on the return they get for the capital they have provided. They have to assess the risk of loaning or investing the money they are entrusted with, versus the applicant’s ability to repay the loan or produce the return on investment promised. The only way for them to do this, is by collecting information from the entrepreneur to do a detailed assessment, and this is often when the gap between the finance provider and seeker is most evident.

The funder needs to gather the information necessary to assess the viability of approving the finance. The entrepreneur often does not know (or understand) what the funder needs from them, or how to respond to some of the questions asked. When it comes to securing funding, many entrepreneurs are unable to provide the information the funder requires to assess their request and to progress to the approval stage.

It is important that finance seekers are well prepared when they are wanting to apply for funding, especially as far as business and financial forecasting and recordkeeping are concerned. Finance seekers need to be able to back up the application for finance they are submitting.

What do venture capital investors look for?

Venture capital is money that an investor puts into the business in the early stages in exchange for shares in the business. There is very little, if any, financial history in the startup or early stages of a business. VCs are not looking for evidence of profits or large income made, rather, they are needing information from the entrepreneur that helps them to assess the future prospects of the business.

VCs usually want to know the following:

- Who the entrepreneur is: They need to be sure that the business has an excellent founder and driver, commonly known as ‘the jockey’. Growing a startup is not easy, they need to know that the jockey has what it takes to make a success of the business.

- If there is a big market: They want to assess if the business is addressing a burning need for a large market i.e. are there a lot of people who will want to buy what the business is selling?

- Product differentiation: How is what this business is doing/going to do different to what is already being done?

- Competitor information: They want to ensure the entrepreneur has done their homework on who and what is already available in the market.

- What is the business model: They want to know how the business is going to make money e.g. is it going to receive monthly recurring business for providing a service etc.?

- What is the ‘go-to-market’ plan: How will the business be marketed and what sales channels will be used to acquire customers?

- Team: Who are the key employees in the business? Who are the owners and are there any other investors?

- Traction is very important: They want to know if any sales have been made yet i.e. has the product been tried in the market and are there people willing to pay money to use it?

- Financial forecast: They need a summary of the next 3 to 5 years’ projected income and expenses in the businesses, with a lot of detail provided on the next/first 12 months.

Once a VC has done an initial assessment of the opportunity and they are interested in possibly investing, they will then do a more detailed investigation, called a ‘due diligence’. They will ask for further information and also go through the business’ financial statements and its history to date. If everything stacks up, they will start discussing investment terms with the founder.

What do you need to apply for SA loan funding?

While VCs look at the future prospects of the business, lenders on the other hand want to see the business’ financial history to date and evidence of its ongoing viability and its ability to repay the loan.

Banks and other private lenders usually require the following information in order to assess a loan application:

- Basic business plan.

- Cash flow projections.

- Outstanding debtors (i.e. customers who owe you money).

- Up-to-date management accounts (i.e. income statement, balance sheet and cash flow statement).

- Latest annual financial statements.

- Latest VAT statement.

- Last three/six months’ bank statements.

- Tax clearance certificate.

Besides these documents, they will ask for the following supporting documents to confirm statutory compliance and to validate the information on funding applications:

- ID documents of owners.

- Marriage certificates of owners (where applicable).

- Company registration documents.

- Office lease or mortgage agreement.

- Shareholder agreements.

- Share register.

- Proof of business address.

- Relevant business licences, accreditations or registrations.