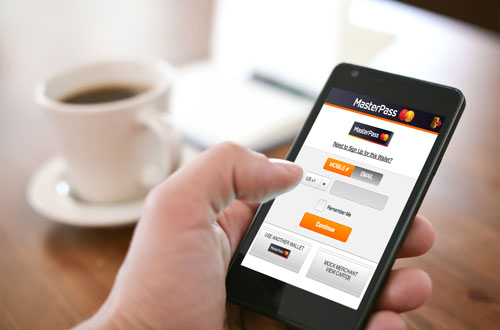

South Africans can now use Masterpass, a global digital payment service by Mastercard, to pay for goods and services at over 30,000 SnapScan merchants in South Africa using their smartphones. This follows a collaboration announced today by Mastercard and SnapScan, a mobile payments solution backed by Standard Bank, at the Mastercard Digital Indaba in Cape Town.

Consumers can download the MasterPass app from their app store, register, and load their credit, debit or cheque cards from any bank into the digital wallet. To pay, Masterpass users simply need to scan a QR code, or SnapCode, displayed at point of sale or online at a wide range of SnapScan merchants including coffee shops, professionals like doctors and market vendors. They then enter the payment amount into their Masterpass app and confirm the transaction with their ATM pin code or a one-time pin code sent to their mobile phones.

Each Masterpass transaction is classified as an Authenticated Mobile Transaction by South African banks, ensuring that consumers enjoy the highest protection from fraudsters.

“With Masterpass, we’re enabling consumers to make secure and simple everyday payments wherever they are and from any connected device, without needing to physically carry their bank cards with them,” says Mark Elliott, Division President, Mastercard, South Africa. “Thanks to our collaboration with SnapScan, we are pleased to offer consumers even more places to pay using Masterpass, which is now the most widely accepted digital wallet in South Africa.”

Since its launch in 2013, SnapScan has grown its acceptance exponentially, especially among small businesses that traditionally did not have access to traditional Point of Sale devices and relied on cash payments. It makes accepting digital card payments cheap and easy, with merchants simply needing to display a QR code at the till, online or on a bill.

“Given SnapScan’s extensive acceptance footprint, the ability to offer merchants a single QR code which will accept payment from multiple mobile wallet solutions such as Masterpass is the driving force behind creating interoperability,” says Lincoln Mali, Head of Group Card and Payments at Standard Bank. “We believe that interoperability between digital payments platforms is one of the keys to driving digital payments usage and acceptance in South Africa.”

By holding rates SARB encourages economy, says FNB

First National Bank (FNB) will maintain its prime lending rate at 10.5% following the decision taken today by the South African Reserve Bank (SARB) Monetary Policy Committee to leave rates unchanged. The decision applies to all prime-linked accounts.

“This year will go down as one of the most difficult periods for businesses and consumers. Even if our economy grows fractionally above zero, we desperately need to achieve far higher growth rates to address the unemployment crisis,” says FNB CEO Jacques Celliers.

“With ratings reviews of South Africa just a few days away, consumers are justifiably wary. By keeping rates on hold at a time when US rates are likely to increase in December, the SARB is taking a courageous step to support our economy and lift confidence,” adds Celliers.

“The prospect of a rating review to sub-investment grade is in itself, however, further undermining the economy. Regardless of decisions taken by the ratings agencies, our economic well-being will be largely determined by our own initiatives. Looking beyond the current climate of caution, we can see improved conditions during early 2017 in large sectors such as agriculture and tourism,” says Celliers.

“I do still encourage consumers to use this period of stable interest rates to create greater personal financial stability. We continue to see stable credit health across our consumer and business sectors; indicating that the majority of customers are weathering current tough conditions. I urge customers experiencing difficulty to approach their bank to restructure loans rather than defaulting,” says Celliers

Says Sizwe Nxedlana, Chief Economist at FNB; “The Reserve Bank’s decision to keep rates unchanged is in line with consensus expectations. While still above the bank’s target, inflation has consistently downwardly surprised over the past few months and should fall comfortably within the bank’s range in 1H17.

Food inflation, which has been the main driver of headline inflation, is indeed showing signs of easing, supported by a general improvement in agriculture commodity prices. Favourable weather conditions also suggest crop production will be better in the year ahead.” (via FNB)

Entrepreneurial innovation is key to improving the local education sector

The South African education sector has been thrust into the spotlight in recent months, eliciting many questions, debates and varying opinions about the current state of the education sector within the country and the potential solutions to an ongoing crisis.

It has been reported that South Africa has one of the highest rates of public investment in education in the world. Accounting for around 7% of gross domestic product (GDP) and 20% of total state expenditure, the government spends more on education than on any other sector1.Yet, innovative entrepreneur and co-founder of SPARK Schools, Ryan Harrison, says that this is currently not translating to tangible results.

He adds that amid all the current negative reports, there are opportunities presenting themselves within the sector to inspire greater outcomes for South Africa’s youth.

Recently awarded the Innovator of the Year® title in the 2016 Entrepreneur of the Year competition sponsored by Sanlam/BUSINESS/PARTNERS, founders Ryan Harrison and Stacey Brewer, shook up the traditional model of schooling and started SPARK Schools – a network of primary schools – in response to the growing opportunities that became available to fix a struggling education system through creativity and innovation.

“The primary education division is one of the hardest areas to innovate because young children need much more stability and hands-on guidance to aid their development, whereas in senior levels, children are able to self-study, which allows for more creativity in the tools they are exposed to within the classroom,” says Harrison.

SPARK Schools is dedicated to delivering accessible, high quality education by using a blended learning programme, which combines traditional classroom teaching and online learning, to