Small to medium-sized businesses are using mobile banking apps while larger corporates are reflecting a slower uptake, this was one of the key findings in the annual KPI ‘BEB and Tracker Study’, released last month, which traces the banking habits of over 700 of the country’s businesses in the commercial hubs of Johannesburg, Pretoria, Cape Town and Durban.

The report shows that less than 20 per cent of companies with turnovers exceeding R700m used mobile banking during 2017.

“Our research demonstrates the higher propensity for mobile business banking uptake among the smaller turnover businesses of R10 million to 20 million where the financial decision maker of the business is also very often the owner and needs greater mobility when it comes to business banking,” explained Rob Hudson, a director of specialist banking and financial market research company, KPI Research and Strategy (Pty) Ltd, which conducts the study every year.

FNB clients are the most active adopters of business mobile banking services

Transaction types

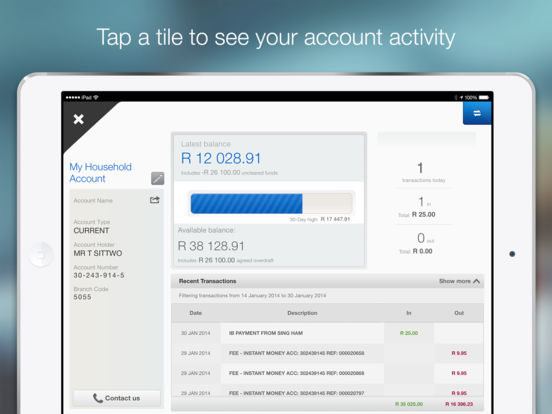

In addition to revealing who is using mobile banking for businesses, the KPI ‘BEB and Tracker Study’ also provided a bird’s eye view of the more important transaction types required of the mobile business banking app.

Financial decision makers using or intending to use mobile business banking services were asked to rate the relative importance of a basket of transaction types or functionalities, the most important ones being; Transfer of funds, Proof of payments, Transactional approvals, Viewing transaction lists/statements, Payment initiations, Notifications and Search for transactions.

The study also revealed that, across all turnover brackets, FNB clients are the most active adopters of business mobile banking services.

Why SMEs are taking advantage of mobile banking tech

Hudson said that accessibility and convenience were driving the trend for smaller businesses to use mobile banking technologies.

“The financial decision makers in smaller businesses are very often the owners or co-owners of the business and a lot more hands-on when it comes to financial administration and banking transactions. They are also usually running their business, on the shop floor, travelling, managing plant operations etc and cannot sit behind a computer for eight hours a day. Therefore, they need greater flexibility and mobility when it comes to business banking.”

He also pointed out that for corporates, the extent and level of transactions were generally far more logistically complex and processed through the organisation’s operational accounting systems, ERP software, and payroll software and therefore needed to be PC-based.

Security and user controls also play an important role in whether or not large companies use mobile banking.

“Although mobile banking apps are a secure channel for transacting, large corporates typically have teams of people involved with financial and banking transactions who are more office-bound and typically dedicated to their financial functions. Therefore, for them to transact off their PCs during office hours affords far more financial control,” he said.