Starting and sustaining the growth of a business is no child’s play. According to BusinessTech, 5 out of 7 South African SMMEs fail in the first year. While running a business has its challenges, there are mistakes entrepreneurs make that can be avoided. However, this is only possible if they are aware of them.

South Africa’s business scene is filled with potential, yet the learning curve remains steep. From cash flow missteps to premature expansion, here are the most common mistakes entrepreneurs make in their first year, and how to avoid them in your business.

1. Starting Your Business Without a Business Plan

Overlooking the importance of a business plan is one of the biggest mistakes you can make in your business. You don’t need a document filled with many pages, but at the very least, you need a one-page strategic plan that outlines:

- What your business does.

- Who your customers are.

- How do you plan to reach them (your marketing).

- How much money do you need to operate and scale your business.

While instinct can be useful in entrepreneurship, you still need structure that provides steps for your business. A well-crafted business plan not only attracts potential funders but also acts as your internal compass.

2. Not Separating Business Funds From Personal Finances

Mixing business and personal finances is one of the quickest ways to flunk your business. This is because you won’t know how well your business is really doing, and come tax season, you’ll be in administrative chaos.

Create a separate business bank account from day one. Use cloud accounting software to track your finances in real-time. Even if you’re a sole proprietor, treating your business as a separate financial entity builds credibility with investors, customers, and financial institutions.

Having healthy cash flow for your business is crucial in helping you sustain and grow your business. Failure to separate business and personal finances hinders your ability to accurately track cash flow.

3. Lack of Healthy Cash Flow

Cash flow is not the same as profit. You might be “profitable” on paper, but unable to pay salaries, rent, or suppliers because clients haven’t paid invoices yet.

In South Africa, delayed payments, especially from corporates and government departments, are an issue for South African entrepreneurs. To combat this issue, entrepreneurs must learn to:

- Set clear payment terms (e.g., 4 days).

- Request deposits upfront.

- Use invoice management tools.

- Build emergency buffers.

- Consider invoice financing.

Failing to manage cash flow is one of the fastest ways a business can collapse, even if you’re generating revenue.

4. Scaling Too Quickly

It’s tempting to scale up when you see initial signs of success, hiring staff, expanding to new markets, and increasing stock. But premature scaling can strain your resources and distract from fine-tuning your core operations.

Ask yourself:

- Is there consistent demand for your product/service?

- Can your systems and team handle more volume?

- Have you achieved product-market fit?

5. Ignoring Market Research and Customer Feedback

Your business might be great to you, but have you considered what your customers think?

A critical misstep is assuming you know what your customers want without actually speaking to them. This leads to poor product-market fit, wasted marketing spend, and sluggish sales.

Use simple, low-cost tools like:

- Surveys (Google Forms)

- WhatsApp feedback groups

- Instagram polls

- Direct customer interviews

Use market research and customer feedback as a means to constantly improve your business and refine the products you offer.

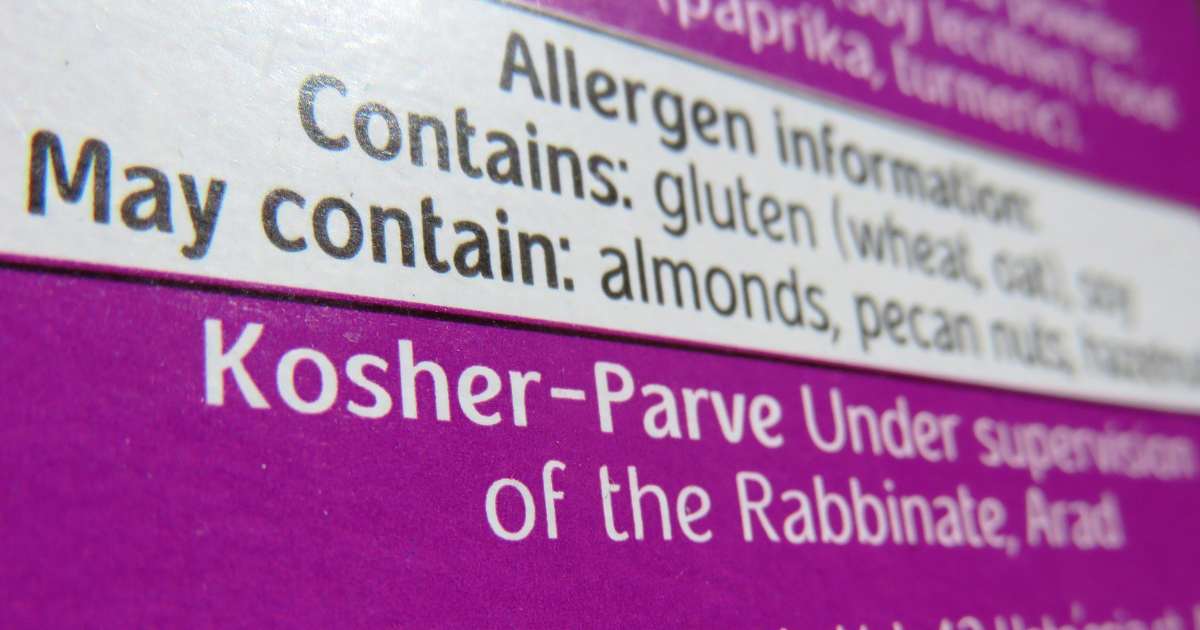

6. Neglecting Legal and Compliance Basics

Non-compliance can cost you more than legal penalties. It can also tarnish your brand.

At the very least, register your business with the CIPC, get a tax number from SARS, and understand industry-specific regulations (especially if you’re in food, logistics, health, or finance). If you plan to employ people, register for UIF and Workman’s Compensation.

Being compliant isn’t just about dodging trouble; it can also open doors. Funders and big clients typically don’t work with unregistered businesses.

7. Trying to Do Everything Alone

Entrepreneurship is already lonely. Don’t make it worse by trying to be the marketer, accountant, designer, and courier all at once.

Outsource what you can afford to (even to students or freelancers), and focus on what moves the needle. Also, take advantage of support ecosystems, join WhatsApp groups, local incubators, and mentorship programmes.

8. Underpricing Products or Services

When you’re new to the game, you might start charging too little out of fear. This could be fear of rejection, fear of competition, or fear of being seen as too expensive.

If you undercharge, you’ll burn out and still struggle to be profitable. Price your products or services based on:

- Market research.

- The expenses incurred to produce and provide your product or service to customers. This includes materials, labor, overhead, and any other costs directly associated with getting your offering to the market.

- The value you provide.