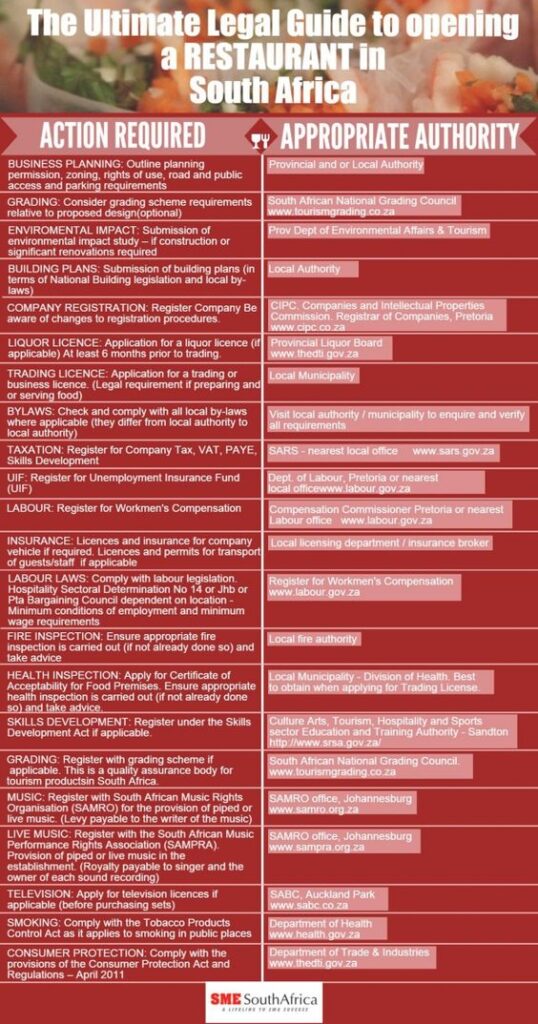

See also: Licensing and permit requirements for the food service industry

The most important regulations that business owners in this sector have to comply with are health and safety permits, licenses for the selling of liquor and tobacco as well as zoning permit to operate in certain locations.

Here is everything you need to know to establish a restaurant in South Africa.

1. Building Planning

Ensure you meet the appropriate requirements, including: zoning, rights of use, road and public access and parking.

2. Fire Inspection

Ensure appropriate fire inspection is carried out – this is done by the Fire Department. For all non-residential buildings, the plans must be approved by the Fire Department prior to applying for the construction permit

2. Company Registration

If you’re setting up a private company ((Pty) Ltd), you need to register your company as a legal entity. It’s mandatory to register within 60 days of starting a business.

The following documents must be submitted:

- Certified ID copies of all indicated initial directors and incorporators.

- Certified ID copy of applicant if not the same as one of the indicated initial directors or incorporators.

- If an incorporator is a juristic person, a power of attorney is required for the representative authorized to incorporate the company and sign all related documents.

- If another person incorporates the company and signs all related documents on behalf of any of the incorporators and initial directors, a power of attorney and certified ID copy of the person is required.

- If a name was reserved before filing of incorporation documents, the valid name reservation document is necessary.

3. Trading Licence

Legislation requires that certain types of businesses be in possession of a valid business or trade license. This can include businesses like a restaurant, coffee shop, a tavern or a health and wellness spa.

4. Health

Every food enterprise needs to apply for Certificate of Acceptability for Food Premises. Business owners need to ensure that the appropriate health inspection is carried out.

If you restaurant has a smoking area, it will have to comply with the Tobacco Products Control Act as it applies to smoking in public places.

5. Taxation

Register for Company Tax, VAT, PAYE, Skills Development. Businesses with a turnover above R 335 000 have to pay tax.

6. Labour

Businesses need to comply with labour legislation, including the minimum conditions of employment and minimum wage requirements. Businesses also need to register for Workmen’s Compensation.

7. Consumer protection

If you supply goods or services you must comply with the Consumer Protection Act 68 of 2008 (the Act) which promotes fair, accessible and sustainable trading.

8. Entertainment

Apply for television licences. If you are broadcasting or playing sound recordings in your establishment, a licence is required either from South African Music Performance Rights Association (SAMPRO) or Southern African Music Rights Organisation (SAMRO).