Female Entrepreneurs: Challenges Women-led SMEs Face in South Africa

Updated on Oct 31, 2025

Overview

Entrepreneurs face many challenges, and in some cases, women even more so. Female business owners across the continent are facing challenges such as securing funding and navigating the skills gap.

For this reason, stakeholders like 22 on Sloane have noted that “Support for women-led businesses must go beyond tokenism”. There is no doubt that men can be women’s greatest allies in accessing more and improved funding opportunities and addressing the many challenges they face; however, this guide solely focuses on the state of female entrepreneurs in South Africa, and doesn’t attempt to solve these issues.

This guide explores the challenges that South African Women face in their day-to-day business dealings. Furthermore, it also looks at technology adoption, skills gaps and funding among these entrepreneurs. It aims to give a clear picture of the struggles that women-led businesses face in the country.

The data has been gathered and provided courtesy of Geopoll and Africa 118. For more information about the state of MSMEs in Africa, keep an eye out for their upcoming MSME Pulse report.

Women-led Businesses In South Africa

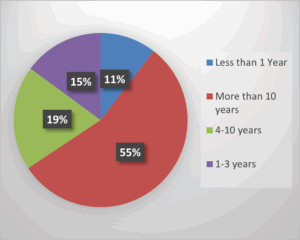

Participants of the survey conducted by Geopoll and Africa 118 have indicated that, from the female-owned businesses, the majority have been in operation for more than ten years (55%). Established businesses that have been operating for more than a year, but less than three years(16%), and businesses older than four years, but less than a decade (18%), make up a third of businesses. Startups fill the remaining 11% of businesses.

These businesses cover Businesses-to-business (B2B), Government and NGO (B2G), and Business-to-consumers (B2C) industries.

31% of these businesses are also youth-led.

Business Sizes

Micro, small and medium businesses can be defined according to the following information:

Micro: The smallest business in the SMME umbrella. It typically consists of one (can be the owner) to five full-time employees and brings in a total turnover of R200 000 per annum.

Small: Small businesses usually have a total of up to 50 full-time employees and project R 6 million in annual turnover.

Medium: Medium businesses can range from 51 employees to 200 full-time employees and have an annual turnover of around R13 million. If turnover is higher than this, even though the number of employees is lower, a business will typically fall into the category of large businesses.

Based on the data provided through the survey, the business size has been categorised according to the number of employees in five categories. These are:

- 1-5 employees

- 6-10 employees

- 10-50 employees

- 51-100 employees

- 101+ employees

The data has shown that almost half of the participants (45%) have between 1-5 employees, falling into the micro category. This indicates how vital support is for micro businesses, because they make up the majority of the SMME umbrella.

In the small business category, consisting of the subsets of 6-10 employees and 11-50 employees, a total of 23% of businesses fall into this definition.

Medium businesses that participated in the survey were represented by 32%, divided into 10% for businesses with between 51 and 100 employees, and 22% for businesses with more than 101 employees.

Challenges That Female-led Msmes Face

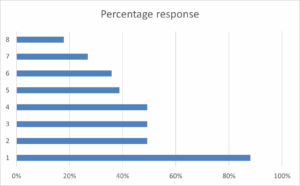

The research indicated that there are eight common challenges faced by women-owned businesses. These challenges consist of technology adoption, high taxation, regulatory compliance, employee recruitment and retention, market competition, political instability, financial constraints, as well as loss of revenue and sales.

Respondents were able to pick all the challenges that are relevant to them from a list, to indicate what the most prevalent challenges were that they all face. Consequently, the majority of respondents indicated that they struggle with technology adoption (88%).

Among female-owned businesses, they face high taxation, regulatory compliance and employee recruitment and retention, all measured at the second highest challenge with 49%. Unfortunately, in response to these challenges, little to no changes have been made to truly address them.

This means that future research has the potential to explore why changes aren’t implemented, potentially also exploring the degree to which the challenge is experienced, and what other priorities are keeping business owners from addressing these challenges.

Interestingly, among the businesses that have implemented significant operational changes to address the challenges, there is no correlation between size, business age or even industry. However, it appears that these businesses are also more aware of emerging challenges and potentially take a proactive approach to addressing these issues, but more data is needed to say for sure.

Interestingly, compared to male respondents from South Africa, the data paints a different picture. 56% made changes to respond to challenges, whether minor adjustments or major implementations.

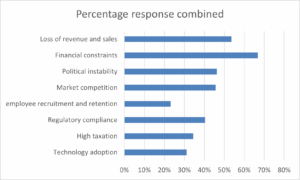

Grouping together data from both male and female respondents, financial constraints beat out technology adoption by far (67% compared to 31%). Where the data shows that women have a loss of revenue or sales as the least of their challenges (18%), adding data from the male respondents shows that this is the second highest concern, drawing in at 54%

This significant change shows exactly why it is so important to look at data that is separated by gender, as assumptions may be drawn about SME’s struggles based on industry research. However, this proves that women’s challenges in business are indeed different from men’s.

Two-thirds indicated that loans are not accessible, 66% while 31% indicated that loans are accessible, and 2% had no idea.

Among women, only 28% indicated that they understood why their loan applications were rejected, citing poor credit, not enough collateral and high debt-to-income ratios.

Barriers to Funding

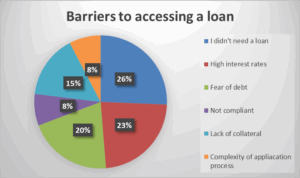

Overall, the main barriers to funding were identified as high interest rates on repayments (23%) and a fear of debt (15%). The third biggest barrier to female-led businesses was the lack of collateral.

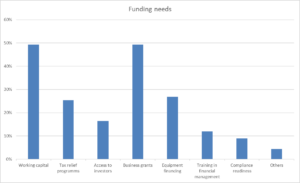

Taking a closer look at the funding needs for these SMEs, 49% of participants said that their biggest funding need is working capital or business grants. This indicates that there is a need for capital to run businesses. The second-highest need, at 27%, is for equipment funding. Drawing in third, participants indicated that tax relief programs are needed too (25%).

Ai Adoption And Technology In Female-led Businesses

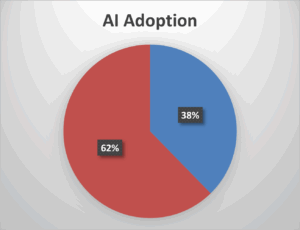

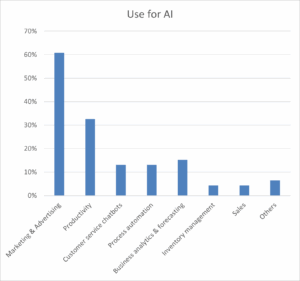

With the advent of Industry 4.0, it is unavoidable that businesses adopt technological advancements such as AI. Among the 62% of women-led businesses that adopted the use of this technology, is divided between marketing and advertising, productivity, customer service, business analytics, inventory management, and sales.

The most common use of AI is for marketing and advertising (61%); however, the survey didn’t indicate for which subsections of this business task the technology was used. This can encompass anything from marketing automation to marketing content creation.

The second most popular use of AI is to manage or track productivity (33%). Business analytics and forecasting (15%), customer service (13%), and process automations (13%) are significantly lower than the top two uses, but have all been introduced for one of two reasons: to reduce cost or to improve efficiency.

Additionally, when the highest reason for adopting AI was identified, participants said that the choice was to improve efficiency (53%). This aligns with the knowledge that one of the key drivers behind AI adoption in businesses is efficiency.

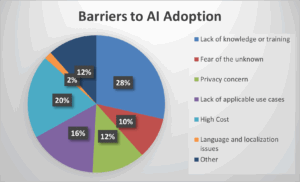

In spite of this remarkable uptake in the use of artificial intelligence among female-led enterprises, many barriers to adoption still exist. The most notable of these is the lack of knowledge or training about AI (28%). This can include the knowledge and understanding of what exactly artificial intelligence can do for a business, the variety of tools that are available on the market, and how to use said tools.

The second-highest reason that businesses don’t adopt AI in their business is the high cost involved. Although every popular business tool includes AI in its offering, and many free-to-use AI models can be accessed on the Internet, to have accurate and in-depth use of these tools, a premium license is usually required. The cost for these can be high, depending on the type of tool and the pricing package, and smaller businesses might find these too expensive to implement.

Interestingly, the survey indicates that the fear of the unknown doesn’t play a significant role in the lack of AI adoption, nor do privacy concerns. Yet, it is important to remember that, even though it might be a lesser concern to the majority of businesses, it is still a concern, nevertheless.

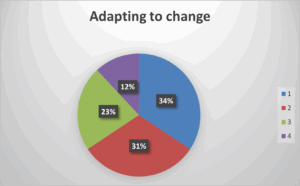

Technology Use

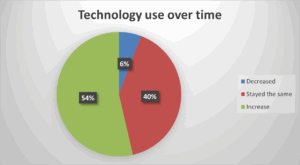

When investigating the use of technology in these businesses over time, it appears that the introduction of AI has caused an increase in the use of technology. More than half of the women (54%) have indicated that their use of tech in their businesses is now more than before. However, one drawback of the survey was that it didn’t inquire according to a measurable scale to what degree technology use has increased. Is it in frequency, because work is shifting online, or did the business grow, effectively doubling the need for more tech-based equipment? It is unclear exactly what the correlation between AI adoption and technology use is.

Similarly, 6% of survey respondents indicated that their technology use decreased, but there is no clear understanding of why. Was this because of distrust in AI, finding easier ways to conduct certain tasks without tech or something completely different, like the nature of a business changing?

This data alone doesn’t paint a clear picture of what the real use of technology is in the hands of female-operated companies.

Types of Digital Tools

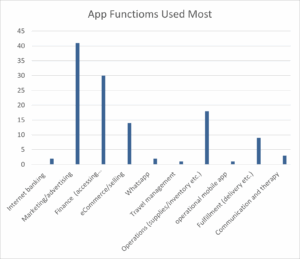

Among the various digital tools used in female-led businesses in South Africa, the most prominent choice is that of accounting and bookkeeping tools that make finance and billing easier.

Other tools used include digital tools for marketing, productivity and e-commerce websites.

When it comes to other app functions that businesses use most often, marketing and advertising tools.

Follow-up questions to this for future research can include what the cost per lead is for these businesses. This question can potentially explore the relationship between marketing, including the cost of the marketing tools, and the profit generated through marketing.