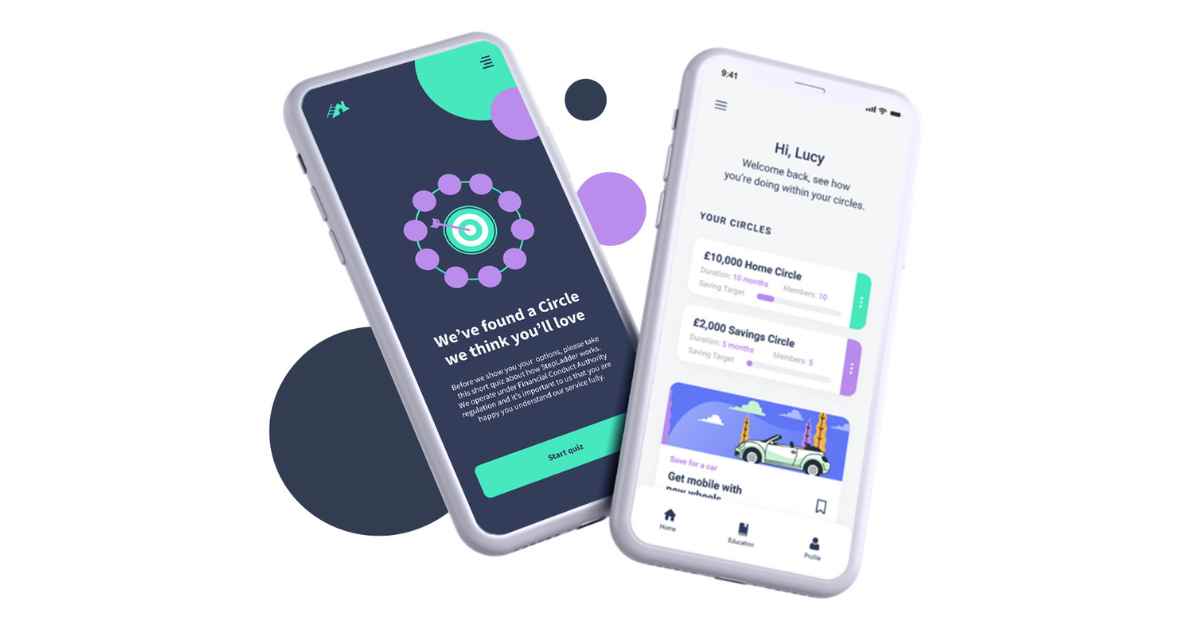

Circles 360 is an all-in-one digital stokvel toolkit for individuals and SMEs to start, manage and grow their group savings businesses. Developed by StepLadder, this tool brings users a way to manage their group savings digitally. Whether you are an entrepreneur, business partner or a community, running your stokvel can be much more efficient than before.

Co-founders of StepLadder, Matthew Addison and Lucy Mullins, have run Savings Circles in the UK since 2017. “With Circles, we knew we could give entrepreneurs and small to medium enterprises (SMEs) the chance to turn their offline stokvels into a ready-to-go online business without having to undertake the thousands of hours of development time to get to where we are now,” Lucy Mullins explains. “ We condensed the best bits of the UK platform into one simple product, Circles 360, for our South African audience.”

She adds that it could be the fastest way to get a small business up and running without the need for lots of integration or technical costs when other funding options are not available.

Circle 360 is Software to Benefit South African SMEs

Circle 360 is software that can take existing offline groups or create new groups, and manage payments, allocation of money, and produce reports on the success of the Circles. “Using the Circles 360 means that much of the admin often associated with running stokvels is done digitally and happens much faster and more efficiently than if you’re keeping spreadsheets or offline notebooks,” Mullins states. “For this reasons it is also a great tool to help with scalability.”

With Circles 360, entrepreneurs can manage up to 1000 participants effortlessly. It would be virtually impossible to keep track of this number of payments, circles, dropouts and draws in offline stokvels.

“Stokvels are such an integrated and well-understood part of the financial ecosystem in South Africa as it’s already a saving system that’s understood and used,” Mullins points out. “We know there’s a huge and primed market for this product in South Africa. We estimate that approximately 11 million people use stokvels to save and they are present in 23% of South African households. Collectively, stokvels manage an estimated R50 billion in savings annually, serving savings, investment, burial societies, and grocery schemes.

“Digital savings circles are particularly powerful for women who have traditionally used offline savings circles as a way to empower themselves financially. We estimate that over 60% of these users are women due to the traditions of Circles being run by the matriarchal members of these communities.

“Women in rural areas are particularly financially excluded and savings groups appeal to them due to the few legal, economic and social barriers to participation. Often, proximity to home plays a key decision maker when joining a local savings group but that can diminish the options women have available to them.

“We have other great features built in to benefit owners and entrepreneurs too. Promotions and offers can be uploaded to enable stokvel leaders and entrepreneurs to generate revenue from partnerships. We do this through our ‘Reason for Saving’ feature which collects the data on participants’ goals. Once we know what people are saving for, we can group them together and find relevant partners to provide a discount on the things they need.”

Mullins presents the following example: If you know you have 20 people all saving to buy a car, an insurance provider would love to give you a kickback to promote their services to your valuable and engaged audience.

“Anyone can start a Circles business. Whether they are social media influencers, pastors and church groups, municipalities, market traders and store owners. It is a great benefit to people already running offline circles, but it’s certainly not limited to people who have been operating such groups before,” Mullins elaborates.

The Adoption of Circles 360 in Africa

Although StepLadder has just launched Circles 360 in South Africa, Mullins states that they have had some great conversations with businesses and individuals in South Africa. “As a product designed for financial inclusion – particularly empowering women – we have found that non-profit SMEs and foundations want to talk to us about licensing the product to support the financial empowerment of the communities they work with.

“We have live projects in Nigeria and since launch in April, we have seen month-on-month growth of 81% in the number of people signing up to Circle spots.

Mullins also mentions that The Warm Heart Foundation is now using Circles 360 to help African farmers raise funds alongside the Global Biochar Program. Circles are a great fit as all the farmers supported by Warm Heart have a shared goal to implement biochar on their farms to boost yield and help combat climate change.

“Mercy and her team at Biochar Life-Kenya love the fact that the platform offers a remote way for farmers to participate in group saving. She explained to us that it’s not always easy to manage these groups when travel is limited and difficult so accessing their Circle information digitally is a huge benefit. It means farmers can keep on top of payments and view their transactions and operators can communicate more effectively without the need for inconvenient physical meetings.”

How Does Circle 360 Work?

Joining the platform is simple and allows entrepreneurs to start their stokvel in less than 24 hours.

You as the operator can start by logging into their Circles portal to set up their Circles 360 space. You can upload your own logo and brand colours. Next, you can choose the onboarding questions such as income level, marital status or debt amount to admit someone into a Circle.

Then, the quick set-up guides take operators through the process of adding existing Circles (if applicable) or how to recruit new people into groups.

“We’ve poured our teams’ expertise into every aspect of running Circles – from how to write terms and conditions to how to reach people via social media. So when someone buys the Circles 360 package, they aren’t just getting a piece of software, they’re also getting the accumulated knowledge from a team who have spent years in this sector,” Mullins assures.

From the participants’ side it is a seamless process of receiving an e-mail or text message, clicking a link, answering the onboarding questions and selecting the Circle they’re eligible to join. Bank statements and ID checks can be requested if that’s how the operator wants to qualify their new participants.

Operators make money by taking a fee on the payments for each Circle, or a pre-payment amount which can be invested while the Circles mature. Money is also made from partnerships which become a key part of revenue generation as the Circles 360 business grows.

To fund your business idea or scale your enterprise, see if you qualify for funding.