UPDATE: Due to the popularity of this article, it has been updated to include additional three crowdfunding platforms, namely Livestock Wealth, Angel Investment Network and Jumpstarter. This article was originally published in February 2018.

“In five years time people will see crowdfunding as a no-brainer when it comes to launching a new idea or project.

“Why would you spend your time and cash on an idea without first asking your future customers if they would buy it? Crowdfunding is the ultimate in the democratisation of finance,” wrote Patrick Schofield in 2013.

Need more information on Crowdfunding and how it can benefit your business? Read Crowdfunding in South Africa

Schofield is behind the country’s oldest and newest crowdfunding platforms – ThundaFund, which launched in 2011, and Uprise Africa, which launched in 2017.

1. Uprise.Africa (Equity-Based)

Uprise.Africa launched in 2017 and is the first equity crowdfunding platform in South Africa. It allows private individuals to invest in early-stage businesses in exchange for equity.

The goal of the platform is to enable everyone to invest in start-ups, not just professional investors.

Qualifying Businesses

Any business can register on the platform to receive funding, Inge Prins, CMO of Uprise.Africa said that they are looking closely at the food and drinks sector for their first few campaigns.

Campaigns

The Uprise.Africa team announced in January that they had launched their first campaign, Storied SA, an initiative by independent South African publisher Jacana Media. The focus of the initiative is on publishing local fiction and creative writing. They have already raised R 10 800 and aim to raise a total of R 3 million.

Requirements

To start with, project creators must have FICA documentation. The platform also allows both non-South African and South African citizens to invest.

According to their website, entrepreneurs behind each campaign will need to be available every day to answer questions from investors and select media appearances.

Funding Amounts

The platform allows users to set their own funding goal, the maximum is R50 million.

Additional Benefits

In addition to linking investors with startups, the platform also serves as a space for small business owners to receive feedback from investors, get help reaching their target market, and test the viability of their offering, according to an SME South Africa article.

2. The People’s Fund (Royalty based)

The People’s Fund is the first black-owned crowdfunding platform in South Africa. The platform launched in 2017 and is a collaboration between one of SA’s largest networking communities for black entrepreneurs, Brownsense, networking community, The HookUp Dinner and Paybook, a digital marketing company.

The platform allows individuals, stokvels and corporates to buy an asset for a business and then be paid a royalty by the entrepreneur for the lifespan of that asset.

Qualifying Businesses

The platform is exclusive to black-owned and innovative businesses.

Campaigns

An example of a campaign is Buy-A-Beehive by entrepreneur, Mokgadi Mabela. The campaign asked investors to contribute towards the acquisition of new beehives. The royalty for those backing Mabela is R 32,40 for every kilogram of honey harvested from the hives they have funded for the next six years.

Requirements

Every one of the entrepreneurs with a campaign has pitched at one of The Hook-Up Dinners and won their respective nights against four other entrepreneurs. Each business is also vetted for business viability and whether their raise requirement is realistic.

Funding Amounts

Amounts have ranged from R 240 000 to R20 million.

Additional Benefits

According to the website, the platform exposes startups to potential customers and ‘evangelists’.

3. Thundafund (Rewards based)

Thundafund is one of the most-known crowdfunding platforms in the country. The fund, which launched in 2011, operates on a ‘rewards-based’, ‘All-or-Nothing’ crowdfunding model, meaning the project creators essentially ‘presell’ project-related items, known as rewards, to backers in return for their financial contribution. These rewards include retail items, recognition and experience.

Qualifying Businesses

According to their website, ThundaFund targets creative and innovative projects that must fit into any of the following 13 categories: art and photography, community, crafts, design, events, fashion, film and video, food and beverages, media and publishing, music, performance; sport, and technology and games.

Campaigns

One of the big fundraisers on ThundaFund includes a wine bar, Proof, located in Somerset West which was launched by entrepreneurs, Dan Crowe and Wayne Mongie.

The two entrepreneurs raised over R 200 000 in 2017 towards achieving their dream of opening a wine bar, according to an SME South Africa article.

Requirements

The fund is strictly for serious projects. The platform has turned down about 1 400 applications from individuals attempting to raise money to pay off their debts.

Other requirements for a campaign, according to the website, include but are not limited to a campaign pitch, a South African bank account, unique rewards for backers, an active social media presence, a PR ‘campaign plan’ covering pre-launch, launch, mid-campaign, pre-closure and closure and finally, an understanding of the target audience.

Project creators also have to be over the age of 18. If applicants are under 18, they will need a project collaborator to register for them, be the payment account holder and take responsibility for the project roll-out.

Funding Amounts

According to the website, project creators can ask for any amount from R5,000 to R50,000, however, they can also ask for millions depending on what the creators are looking to fund and the profile of the investors/backers.

Pledges average between R 100 and R 1 000 and can range upwards substantially.

Additional Benefits

ThundaFund offers free marketing. Campaign creators are also able to test the viability of their product and target market based on whether anyone invests, and also who invests.

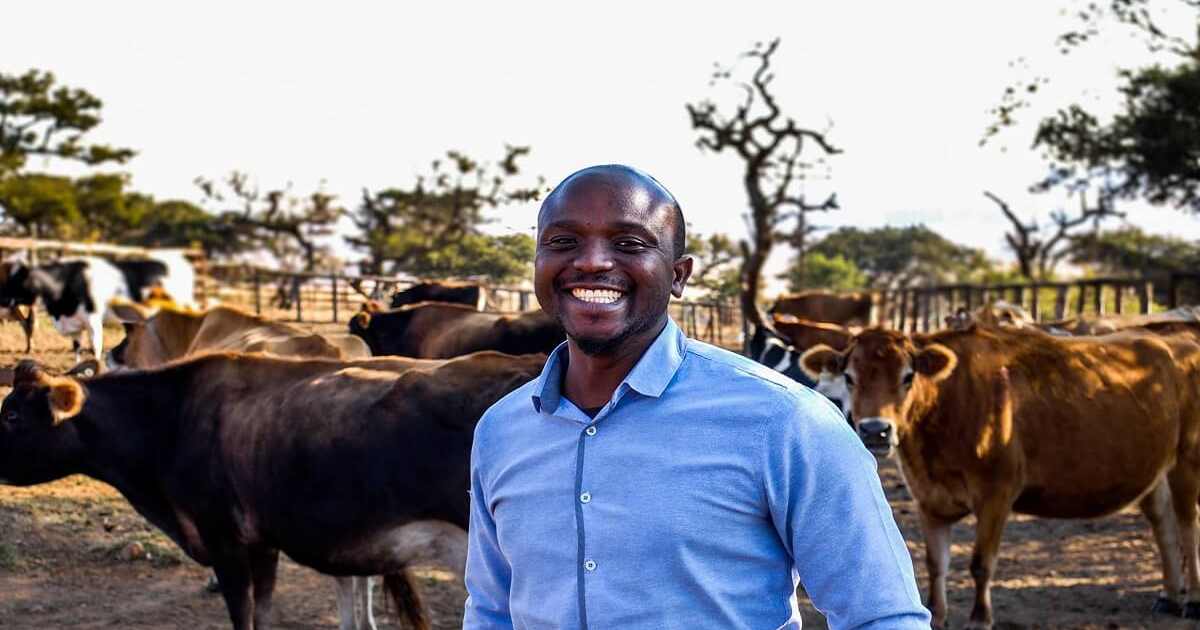

4. Livestock Wealth (Equity based)

Livestock Wealth is a “crowdfarming” platform. Crowdfarming is the crowdfunding of farming by members of the public.

Livestock Wealth facilitates the connection between farmers who need working capital and investors who want to invest in growing assets, but don’t have the means to do so themselves. They set the agreements in place.

Livestock Wealth was founded in November 2014.

Qualifying Businesses

Livestock Wealth enables everyone to be a farmer by investing in high-value agricultural products over a fixed term, you therefore own an organic beef farm or Macadamia Nut Trees and share in the profits of the farm.

Requirements

You can register on the Livestock Wealth app, buy your product and keep track of your investment.

Funding Amounts

The different investments available are as follows:

- Invest in a Macadamia Nut Tree for R 2 000 and then earn between R 3 947 65 and R 4 163,95 after six years.

- Invest in a pregnant cow for R 18 730 taking the 12-month option. Earn between R 20 603 and R 21 352 after 12 months.

- Invest in a Connected Garden, which is a fully-stocked organic vegetable garden that is leased out to farmers and managed on your behalf. It costs R8200. You will earn R220.00 per month which is your portion of income earned from the sale of vegetables to local farmer’s markets, restaurants and other off-takers. This equates to a total income of R13,200.00 over five years.

- Invest in a free-range calf for the cost of R11 529. This calf is between the ages 12 to 18 months old, it is raised to produce premium free-range beef over a period of six months. You can earn between R12,105.00 and R12,336.00 after six months.

5. South African Angel Investment Network (Membership model)

The South African Investment Network is a paid membership platform. As part of their membership, entrepreneurs get the opportunity to pitch and get connected with angel investors, both locally and internationally.

Currently, the network has over 349 thousand investors who are made up of angel investors, family offices and venture funds.

The rates per membership range from the R1 199 per month Pro package, the Global Pro at R 2 299 per month to the Executive package which costs R 19 999 per quater. Each package has different offers and benefits.

According to the website, the network has raised R4 billion for its members.

To raise capital, each entrepreneur is allowed to pitch their business, and set their capital requirements and the minimum amount that an investor can give.

Qualifying Businesses

The investors look at all stages of business and across all sectors.

Campaigns

Visionwork Capital is an asset rental finance management company based in the KwaZulu-Natal. They provide equipment rental finance.

The business has assisted more than 90 businesses with rental finance transactions, and they have empowered around 100 SME businesses. Their target funding amount is R50 million.

Requirements

Entrepreneurs first register and are then able to pitch using the online form.

Must-haves included the company’s registered name and a link to the business’ website.

To see what each paid package offers, download the Pitch Walkthrough.

According to the other website, part of a successful campaign is providing a full picture of your business, including “a brief introduction to the people helping to drive your business … Give us a concise insight into the highlights of their CV: where and what they studied, what they have worked on.”

Funding Amounts

Entrepreneurs can share the maximum amount of funding needed and also, the minimum each investor can give. You are also able to view different investors’ investment ranges.

According to the website, you can accept funds from investors at any time – you do not have to reach any funding target. “Investors transfer to you directly so there is no commission fee from us.”

Additional Benefits

The network’s system will match an entrepreneur’s pitch with the right investors based on investment amount, region and sector(s). Pitches can be edited at any time. Entrepreneurs are also allowed to give “nudges” which is a way to draw investors’ attention to their pitch.

6. Jumpstarter (Rewards-based)

Jumpstarter is a South African non-profit organisation (NPO) that is a rewards-based crowdfunding platform.

The NPO which was founded in 2011, offers a way to fund creative projects for individuals, businesses and charities. According to the website, Jumpstarter has done 18 projects and funded R 520 920.

Project creators (entrepreneurs) receive donations in exchange for tangible rewards like products, benefits, and experiences.

Jumpstarter has an “all-or-nothing” crowdfunding approach which means that every Jumpstarter project must be 100% funded before its time expires or no money changes hands. Every project creator has to set their project’s funding goal, donation rewards and deadline.

Qualifying Businesses

Jumpstarter allows creative projects which can range from art, design and fashion to film, food and technology. Creators of the projects, whether it is filmmakers, musicians, artists or designers have complete control and responsibility over their projects.

Campaigns

Sister craft brewers, Melanie and Tania Nieuwoudt who hail from Cederberg sought funding for a legal battle on the Jumpstarter platform. Their funding goal was R 50 000. They successfully secured 61 backers pledging a total of R 52 000.

Requirements

Every project must have a clear goal, like producing an album, publishing a book, or a work of art. Other requirements include:

- A funding goal

- A project deadline

- Jumpstarter profile name

- Rewards tiers that have already been selected by a backer

- Project description

- Project video and image

- Project FAQs

Funding Amounts

According to the website, these are the platform’s fees:

- For-profit project, successfully funded – Jumpstarter applies a 7% fee to the funds collected. Payments pledged exceeding R 250, are refundable.

- Registered Non-Profit Organisation project, successfully funded – Jumpstarter applies a 5% fee to the funds collected. Payments pledged exceeding R 250, are refundable.

- ISASA or RSA Public School’s project, successfully funded – Jumpstarter applies a 5% fee to the funds collected. Payments pledged exceeding R 250, are refundable.

Additional Benefits

The Jumpstarter team can select a Staff Pick, this is for projects that stand out. These projects benefit from greater awareness on the platform.