Guide to Funding on Old Mutual SMEgo

Updated on Jul 18, 2024

Introduction

Old Mutual understands business, through SMEgo. In fact, they have made it their mission to assist small to medium-sized enterprises in running their business. From providing them with tools like the award-winning SMEgo platform to help manage their cash flow, to having access to various funding options from different funders. The platform was built to empower South African businesses to connect them with opportunities that unlock their growth and simplify operation.

By applying for funding through SMEgo, businesses have the opportunity to receive funding up to R 20 million, once the application has been approved. Furthermore, entrepreneurs can save time by doing this on their mobile devices once they have downloaded the SMEgo app on IOS or Play Store.

Here are the guidelines below on how to apply for funding and the various funding products offered.

Apply For Funding Through Smego

What is SMEgo?

SMEgo is Old Mutual’s dedicated tool for cash flow management, funding solutions and business insurance for enterprises. The platform enables users to generate financial documents such as invoices, statements of accounts and quotes. Entrepreneurs are able to track payments and link their bank accounts.

Since the platform’s inception, it has grown tremendously to truly be the comprehensive business solution its makes aimed it to be. Aside from the above functionality, the platform now has premium add-ons that can be purchased separately from the main subscription. These include useful tools for such as the HR, Payroll and Legal tool, the Accounting dashboard, and the Marketplace functionality. The revamped SMEgo boasts a sleek layout that neatly show these various sections.

Why Apply for Funding on SMEgo?

Applying for funding on SMEgo has many benefits. The first of these is that it saves entrepreneurs time. Instead of researching different institutions to accommodate the type of funding you enquiring for, our platform offers numerous funding products all in one central place with various funders to choose from.

Secondly, it keeps track of all applications that were submitted by the subscriber. You have a view of all your applications that were submitted and the ability to know if it was approved or declined.

To improve your business’s chances of funding. You need to ensure the business has a minimum operating trading record for more than twelve months. The business achieved a minimum annual turnover of R 500 000 and is a registered entity with CIPC.

All of the funding options also require documents such as financial statements, bank statements and company registration.

Steps in Applying for Funding on the Platform

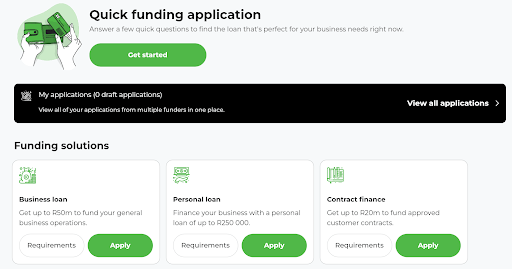

When clicking on the black banner to view all applications, users can filter through their applications.

Filters can be set to show applications according to their status (submitted, under review, approved or declined). It can also be viewed according to the type of funding that was applied for or the time at which it was submitted.

Additionally, applying is made easy thanks to a built-in questionnaire that helps identify the funding option your business needs.

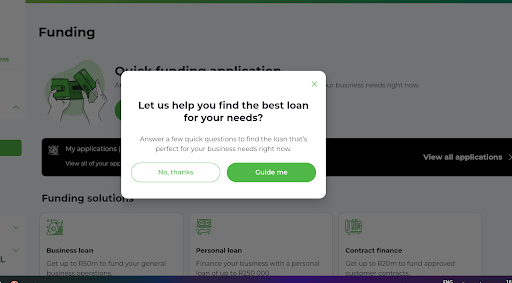

Once a user selects the Funding tab, a pop-up immediately asks if the user requires guidance in finding the right funding option.

Use the Questionnaire to Find the Best Loan for Your Needs

The questionnaires provide users with the best option, after a series of questions asked to users on financial aid for funding. The questions relate to how much money entrepreneurs are looking for if they are registered businesses with CIPC and have a BBBEE rating, the background of the business such as the amount of time it has been in business, annual revenue and the industry in which it operates.

Once all the questions have been completed, a list of relevant funding options to apply to will appear.

To reach this questionnaire without accepting guidance on the pop-up, subscribers can click the Get Started button.

Various Funding Options Available

Business Loan

A Business loan is any funds that are borrowed to cover business expenses.

For a business loan through the SMEgo funding section, applicants can receive up to R 50 million to fund any general business operations. The loans available in this category consist of both revolving credit facility and overdraft.

Revolving Credit Facility

This facility is for working capital, assisting the business with unexpected projects, or shortfall in salary expenses or inventory. This facility is perfect for businesses that need funds to operate their month-to-month operational activities, and it also allows the users to gain access to funds that they were debited on.

Overdraft Facility

This facility is designed for businesses that need funds to manage their daily operation activities. For any outcome or shortfall that occurs within the day, the facility allows the user to have constant availability of funds without frequently disbursing, this facility enables the functionality that the business constantly has funds available.

Contract Finance

Contract finance is a type of advance that businesses obtain when they do not have the necessary funds to complete a project or delivery, it assists businesses to deliver on a specific contract. The money is used to hire people, rent or buy equipment or acquire any vital items to complete a project or job.

Purchase Order / Tender Finance

Purchase order finance, or tender finance, is applied when the business has a valid purchase order or tender from a customer. The funding may be used to fulfil the request of the customer regardless of whether it is used to acquire inventory or equipment.

Asset Finance

Asset finance is funding that helps you obtain any assets to run or grow your business. It is a type of secured funding that can also be used to expand your premises.

Assets include office automation equipment, capital equipment finance and much more.

Trade Finance

Trade finance is a type of working capital that businesses use for domestic and international trade transactions. This includes purchasing inventory or equipment, various good that needs to be imported or exported.

Early Invoice Payments

Early invoice payment funding is used when businesses apply for funding to cover the cash flow gap between when your debtor might complete payment for the month. To prevent your business from struggling with cash flow by debtors who didn’t pay on time. Money is deposited into your business account within 24 hours of the application being approved.

What’s more, is that there are no hidden charges. However, the fees that apply are as low as 2% per month and this loan has flexible repayment terms.

If the business is not successful through funding, the directors of the company may apply for a Personal loan.

Personal Loan

A personal loan is a lump sum of money that an individual borrows to make a purchase.

A personal loan can be a good option for your business. It can provide you with access to the necessary funds to start, run or grow your enterprise. With Old Mutual’s personal loans, an entrepreneur can receive up to R 250 000.

Minimum Requirements

The minimum requirements that you need to meet are:

- To be an employee or on a full-time contract for at least three months

- Be a South African citizen

- Earn a minimum of R 2 500 per month before deductions

- Between the ages of 18 and 60

- Not be self-employed or an employee of a business you own

Documents Needed for Applying

You will need the following documents to apply for a personal loan:

- Your Identity Document (ID)

- Bank statements for three months

- Your most recent payslip

Conclusion

SMEs no longer need to struggle to identify relevant funders. They also don’t need to waste time researching what funding options are available to them, or what the requirements are. The SMEgo platform conveniently brings this to all entrepreneurs.

Applications take approximately a week to be reviewed and either approved or denied. As soon as there is an update on the progress of your application, you will receive a notification via e-mail from our trusted consultant and funders.

With just a few clicks applicants can see for what types of funding they qualify for from which funder and apply. Feedback is timeously provided in-app and can be reviewed.

To find out more about how SMEgo can help your business grow, send an e-mail to smego@oldmutual.com. You can also phone (+27)21 137 6078 or (+27)67 718 5598. To register or subscribe for SMEgo, please go to www.smego.co.za or download the app on the Apple App Store or Google Play Store’