When it comes to small to medium-sized enterprises (SMEs), a lot is going on every day. From managing customers, stocktaking, to ensuring your employees are working well. Because of how busy it gets, admin tasks like staff records can get lost in the chaos, however, it’s very important that you consistently update and manage your staff records.

What Are Staff Records?

In South Africa, staff records are official documents and (sometimes) digital files that document an employee’s entire employment relationship, including recruitment, termination (if applicable), their name, job description, hours worked, remuneration, and leave.

Your staff/employee records are an essential part of your compliance documentation and also help you with tax filings and submissions for the Unemployment Insurance Fund (UIF).

In this article, we look at staff/employee records, the laws around them and how to effectively do it as an SME founder.

Staff Record Laws in South Africa

Here are some of the laws that outline record retention limits:

Protection of Personal Information Act (POPIA)

Section 14 of POPIA states that the records of personal information must not be kept without consent longer than necessary for achieving the purpose of the information collected. Records can be retained longer when required or when authorised by law or contract.

Companies Act

According to section 24 of the Companies Act, there is a general rule for company records outlining that any documents, accounts, books, writing, records or other information that a company is required to keep in terms of the act and other public regulations must be kept for seven years or longer as specified in public regulations.

Basic Conditions of Employment Act (BCEA)

Sections 29 and 31 of the BCEA state that employee records outlining the information of an employee and their employment terms and any other prescribed information must be kept for three years after the termination of employment or from the date of the final entry in the record.

The BCEA is the regulation that aligns most with how to comply with the law through employee records. POPIA and the Companies Act are also good guidelines for you to follow when it comes to managing employee records.

Details on Employee Records to be Kept

As an employer, you need to have a clear understanding of which employee records must be retained to avoid any severe penalties. These records can be kept electronically or through copies of documents scanned and kept online.

The BCEA lists the following particulars as necessary for staff records:

- The employee’s job description

- The date on which employment commenced

- How many hours does the employee work

- Remuneration details

- Any leave provisions

- Notice period

As an employer, you have to retain this data for three years after the employee leaves. The South African Revenue Service (SARS) requires you to keep all records for a period of five years, except if your employee works less than 24 hours a month.

The BCEA also states the following details must be in your staff records:

- Name and occupation of employee

- The time worked at your company

- The salary paid to the employee during the time

- Date and birth of any employees under 18 years of age

- A wage and attendance register

It’s also advisable to keep any information your employee is entitled to, such as copyright and patents, and restraint of trade agreements.

Challenges of Keeping Staff Records

Maintaining your employee records can be difficult, especially with the amount of admin needed for compliance. Here are some of the challenges and solutions for managing staff records.

Challenge 1: Data Security Risks

Protecting the sensitive information of your employees from data breaches or unauthorised access is a critical concern. With many cyber threats plaguing South African companies – especially ransomware – sticking with data security best practices is crucial to ensuring the security of your employee records.

Solution: You can invest in good HR software, which can offer you a range of tools and features to help your business collect, store and manage employees’ personal data. You should also develop a data security policy and procedure document to ensure your employees also follow cybersecurity best practices.

Challenge 2: Cybersecurity Compliance

Employment laws and regulations can vary depending on your industry, making it quite a challenge to ensure your records stay compliant. Keeping up with industry-specific regulations can be overwhelming; if neglected, it can lead to costly legal issues.

Solution: It’s important that you stay up to date on any regulatory changes in your industry or the country. Consider hiring a consultant to monitor changes in employment law or train one of your employees. Also, ensure your HR department is regularly trained on compliance issues to help mitigate risks.

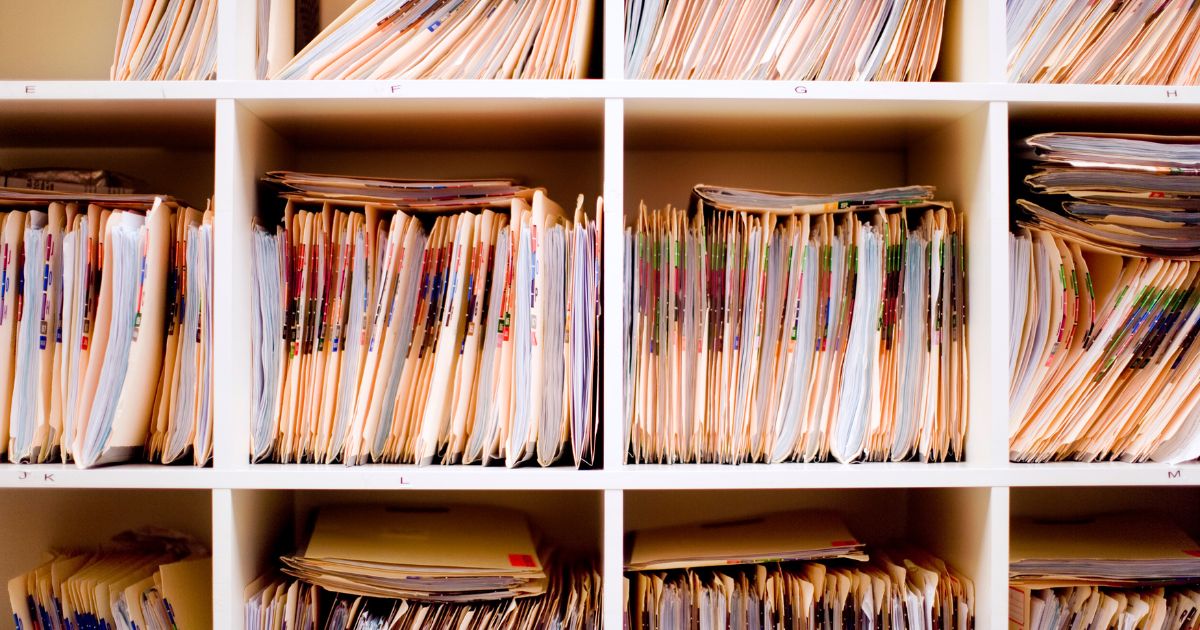

Challenge 3: Managing Large Volumes of Data

As your business grows and you hire more employees, the amount of data you need to manage also increases. Organising, storing and retrieving this information can become increasingly difficult, which can lead to inefficiencies and errors.

Solution: Leveraging an HR system that handles large amounts of data can help you ensure all information is up-to-date and securely stored. Additionally, regular audits of your records can not only help maintain compliance but also help you declutter unnecessary information.

Challenge 4: Accuracy and Consistency

Inconsistent or inaccurate staff records can lead to many errors such as payroll issues, compliance breaches and poor decision-making. Without a streamlined process or robust platform, ensuring accuracy and consistency can be challenging.

Solution: You can use HR software that automates data entry and updates to ensure accuracy and consistency in your record-keeping processes. Also, ensure you train your staff on best practices for maintaining accurate and consistent records, and perform regular audits to catch and correct any issues.

By recognising which issues you have in your business and applying the right solution, you can maintain well-organised, secure and compliant employee records.