The following content is paid for by Mobipaid.

According to the South African Banking Risk Information Centre (SABRIC) lost and/or stolen debit card fraud amounted to 42.5% of all debit card fraud in 2018.

South Africa faces a unique challenge when it comes to payment security, one which demands a modern solution to physically carrying a bank card on your person. This is a primary reason why Mobipaid, supported by VISA, has developed a method for seamless, contactless transactions using the Mobipaid Wallet which allows the cardholder save up to five cards securely in a PCI DSS level 1 environment. Now your customers can leave their cards at home and don’t need to fill out long-winded banking detail forms online. They simply select the Mobipaid Wallet at checkout, enter their unique PIN and pay.

Merchants are faced with increasingly weary consumers who don’t like sharing their account information carrying a bank card or handing it over to service staff. In the wake of COVID-19 sharing contact with objects such as cards and merchant hardware is no longer ideal either. The industry is adjusting to this new climate by taking both increased security and healthcare into consideration by using Mobipaid.

How does Mobipaid work?

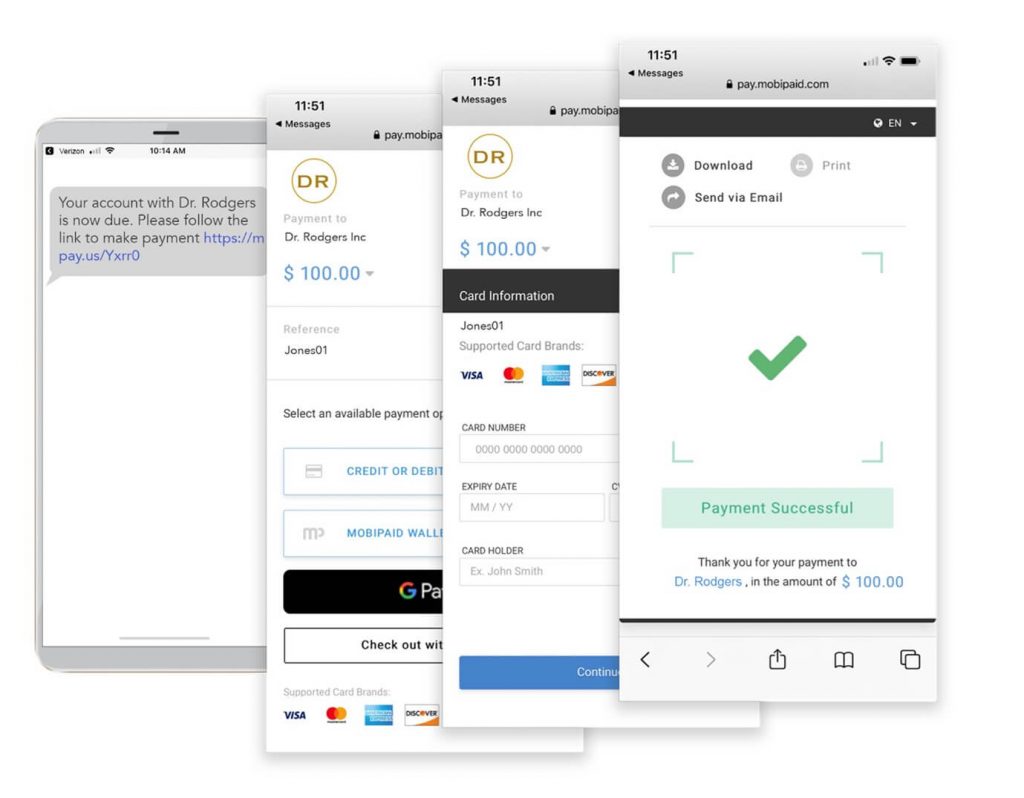

Mobipaid provided the merchant lots of different channels to get paid and is a comprehensive overhaul of the way South Africans can transact, featuring entirely contactless transactions whether from your website, social media pages or within your physical retail outlet. Whether you’re running a Facebook business, a restaurant, gathering donations or simply running a Gumtree advert, Mobipaid offers a comprehensive payment solution involving a fully customised checkout and payment page for your customers.

One of several key features which sets the system apart is the fact that your customers do not need to download an app or fill out detailed account forms. A lot of sales are lost at checkout because of very high cart-abandonment rates from frustrated first-time users. It’s good news for physical vendors as well as it means that the consumer can complete your transaction without a bank card or an app on their phone.

Detailed Features Include:

• No card readers or special devices required to pay or get paid

• Multiple sales channels: via WhatsApp or SMS, in person, online & social media

• Customers pay directly from their mobile or internet-enabled device

• Add any number of users to increase sales

• A Virtual Terminal to take card payments in person

• No customer app, no account registration, no password or login

• Customer wallet offered for regular customers who wish to store cards

• No redirect to a third-party service provider website to get paid

• No monthly or platform fees: transparent transaction-based pricing

• You never have to ask for your customers’ card information again

• Your customers’ payment is automatically PCI compliant and secure

• Use plugins for systems like WordPress/WooCommerce, Shopify and more

Find out more about available features here.

Digital and Physical Vendors Covered

Physical vendors can use a point of sale (POS) QR code which replaces current mobile POS hardware, reducing overheads. Simply print any number of QR codes from your Mobipaid Merchant Portal and display it at the POS for your customers to scan using their smartphone cameras or QR reader. The QR code can be printed on labels, or displayed on tables at eateries, reservation desks and more. Remember, no app or registration for your customers to pay you!

For digital vendors the instantly generated POS link is simply copy/pasted to your website or webstore to create a checkout. Check from our list of Payment Plugins and a live check is can follow in minutes. Sell across Facebook, Instagram, WhatsApp, Skype and many more.

Pay Less, Get More

Other than a brand new level of modern convenience and efficiency, the next best thing about the Mobipaid system is probably the billing structure, which strips all unnecessary overheads from the environment. With Mobipaid, as a vendor, you only pay for what you use – there is no standard monthly billing rate applicable. This means that you’re not paying unless you’re making money. There are absolutely no setup or monthly charges, and all of the following are provided free of charge:

• 24/7 Support

• Your own Merchant Portal

• Your own QR code(s)

• PCI Compliance

• Auction and donor platform

• Send payment requests on instant messaging platforms like WhatsApp

• Unlimited email payment requests that can be sent from your own domain

• Unlimited social media campaigns or create weblinks of items/services to sell

• API Docs and Sandbox Test Environments

• Payment technology innovations & monthly upgrades

• Existing integrations to WooCommerce, Shopify and others

• CRM & PMS management software integrations e.g. Oracles Opera PMS

Find out more about costing here.

South Africa needs a comprehensive scan to pay system which takes its unique security needs into account and cuts down on transaction abandonments because of complicated forms or the need to download a specific app. The merchant/consumer relationship relies on trust and convenience and Mobipaid, backed by VISA, brings all of these elements together wherever you are with its contactless transactions.

Don’t lose another sale because a customer forgot their card, or won’t allow you to use it. Don’t lose another sale because of complicated POS forms and apps which go offline or don’t interact properly. Mobipaid is the complete solution for your campaign, business or advert payment collection, which doesn’t force you to adapt to it, but rather adapts seamlessly to your existing business model.

Find out more about contactless transactions by visiting mobipaid.com today.

WIN with Mobipaid! Register your free account before Jan 10 and stand a chance to win a Nintendo Switch or Xbox Series S console.